The Allocation Gap

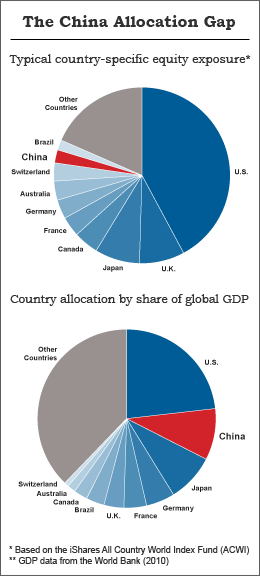

This article will make the case that most investors are under allocated to China for a variety of reasons including our natural home-country bias and the lack of readily available information about viable China-focused portfolio strategies.

Read MoreYour Portfolio: Getting it Right

This article will guide investors through the process of determining an appropriate level of exposure to China, including the type of investment vehicles that should compose that allocation.

Read MoreMix & Match: Diversification Options

This article will outline various guide portfolios to gain exposure to China. The article may be connected to the “Your Portfolio” article.

Read MoreRisks and Expectations

This article with clarify what investors should expect from their China-focused strategy and how to adjust their strategy on a going forward basis in the face of various potential risks. This will include a “Risk List” to watch for when managing a portfolio with a material allocation to China (macro risks, rising correlations, etc).

Read MoreCommunicating Your Strategy

For professional financial advisors and individual investors alike, being “ahead of the curve” is challenging from more than just an investment perspective. Clearly explaining your strategy to skeptical clients, colleagues and friends is a task in and of itself. This article will give investors tools and talking points to succinctly convey the value of their China-focused strategy and why it makes sense in their overall portfolio.

Read More